In the world of online trading, specifically in the realm of binary options, strategies are crucial. One such method gaining traction is the pocket option otc strategy pocket option otc strategy. This article delves into the nuances of this trading strategy and how traders can effectively utilize it to maximize their profits.

What is Pocket Option OTC Trading?

Pocket Option is a popular trading platform that allows users to engage in binary options trading. OTC (Over The Counter) trading refers to trading that is conducted directly between two parties, typically facilitated by a broker, rather than on a centralized exchange. This provides a unique opportunity for traders to access a variety of assets and market conditions that may not be available through traditional exchanges.

The Advantages of OTC Trading

OTC trading comes with several advantages that can enhance a trader’s experience and potential for profit:

- Accessibility: OTC trades can often be executed at any time, offering greater flexibility for traders.

- Diverse Assets: Traders can access a wide range of assets, including cryptocurrencies, commodities, and stocks, giving them more options to diversify their portfolios.

- Less Market Manipulation: As trades occur directly between parties, there is usually less manipulation compared to centralized exchanges.

Understanding Pocket Option OTC Strategy

The Pocket Option OTC strategy involves several key components. It is essential for traders to understand and implement these components effectively to enhance their trading outcomes.

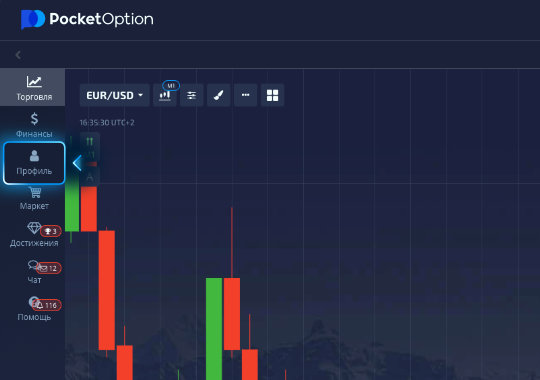

1. Market Analysis

Successful trading begins with thorough market research and analysis. Traders should utilize technical analysis tools, such as charts and indicators, to assess market trends. Moreover, understanding fundamental factors that influence price movements is crucial. Staying updated with news and events in the relevant market can provide context to trading decisions.

2. Risk Management

An essential part of any trading strategy is risk management. Traders should define their risk tolerance level and stick to it. One common approach is the 1% risk rule, where traders do not risk more than 1% of their account balance on a single trade. This helps to protect the account from significant losses and enables it to survive volatile market conditions.

3. Choosing the Right Assets

With a plethora of options available, choosing the right assets to trade is critical. Traders should focus on assets they understand and those that exhibit volatility and trends. Researching how different assets respond to market conditions can also lead to a more nuanced trading strategy.

Effective Strategies for Pocket Option OTC Trading

Here are some effective strategies that traders can adopt while utilizing the Pocket Option OTC platform:

1. Trend Following

Trend following involves identifying the current market trend and making trades in the direction of that trend. Traders can utilize moving averages or trend lines to ascertain the direction and strength of a trend. This strategy works well in a trending market but can lead to losses in sideways or choppy markets.

2. Range Trading

Range trading occurs when prices move within a specific range. Traders can buy at the low end and sell at the high end of the range. Key support and resistance levels are vital in this strategy to determine when to enter and exit trades. Traders need to be cautious as breakouts can occur, leading to potential losses.

3. News Trading

Trading based on news events can be a double-edged sword. While it can lead to significant price moves, it also carries risk due to potential market volatility. Traders should keep an economic calendar handy to stay updated on upcoming news releases and earnings reports that could impact the markets.

Utilizing Demo Accounts

Before diving into live trading, utilizing a demo account is crucial. Pocket Option offers a demo account for traders to practice their strategies without risking real money. This allows traders to familiarize themselves with the platform, test different strategies, and build confidence in their trading abilities.

Conclusion

The Pocket Option OTC strategy opens up a world of opportunities for traders looking to maximize their potential in binary options trading. By understanding the nuances of OTC trading, engaging in effective market analysis, practicing proper risk management techniques, and adopting the right trading strategies, traders can significantly enhance their chances of success. Continuous learning and adaptation are essential in the ever-evolving trading landscape, and by leveraging the tools and resources available on platforms like Pocket Option, traders can equip themselves for profitable trading adventures ahead.